Most home owners learn that chief benefit of refinancing getting a lowered interest. While this is one of one’s essential benefits associated with refinancing, it is far from the only person.

As the home loans we have experienced every benefits out-of refinancing. We like to aid the clients just take these benefits and higher its total financial position.

1. Down rates

Of course, lower interest rates may be the first observed advantage of refinancing. This will make feel as the obtaining less rate of interest actually has an effect on the bucks that you spend monthly. Moreover, they lowers the total amount you are going to need to spend across the lifestyle of financing.

Either consumers think that a small improvement in rates aren’t worth the problem off refinancing. However, refinancing having a specialist mortgage broker’s help, are quicker, simpler and stress-totally free than you possibly might predict. As well as a little change in interest can potentially rescue you thousands of dollars along side mortgage label.

dos. The fresh lenders

When you refinance there is the chance to imagine a loan with a brand new financial. Many reasons exist as to the reasons this might be sensible to you. You may be let down along with your latest lender’s customer support and you can just want to come across a lender alot more focussed to the support service. You may be self-employed otherwise an expat and need a lender that provide functions geared to your special points. Otherwise your role could have altered maybe now you have several revenues or have obtained an inheritance.

No matter what disease, there are times when you may find trying to find a special bank getting a transform. Refinancing form you can look at the fresh lenders (both lender and expert loan providers) which you’ll give you services and products payday loans Brewton that suit you finest.

step three. The brand new mortgage items

A unique advantageous asset of refinancing is to get the means to access a separate version of loan device. It is as simple as modifying off a varying speed mortgage to a predetermined price mortgage. Otherwise it could be seeking financing which provides a beneficial redraw studio, down costs otherwise most useful customer service.

cuatro. Equity access

If you have got your house for some time, or its somewhat preferred within the well worth, you created collateral of your home. One of several great benefits of refinancing is able to accessibility you to definitely collateral for your own personel requires, and additionally to construct alot more wide range.

Being able to access house equity can supply you with even more investment to blow. You believe throughout the using it back to your own property, to purchase another type of homes, expanding with the industrial possessions or boosting your newest funding collection. Whatever you determine, domestic guarantee can provide you with an effective foot to begin with.

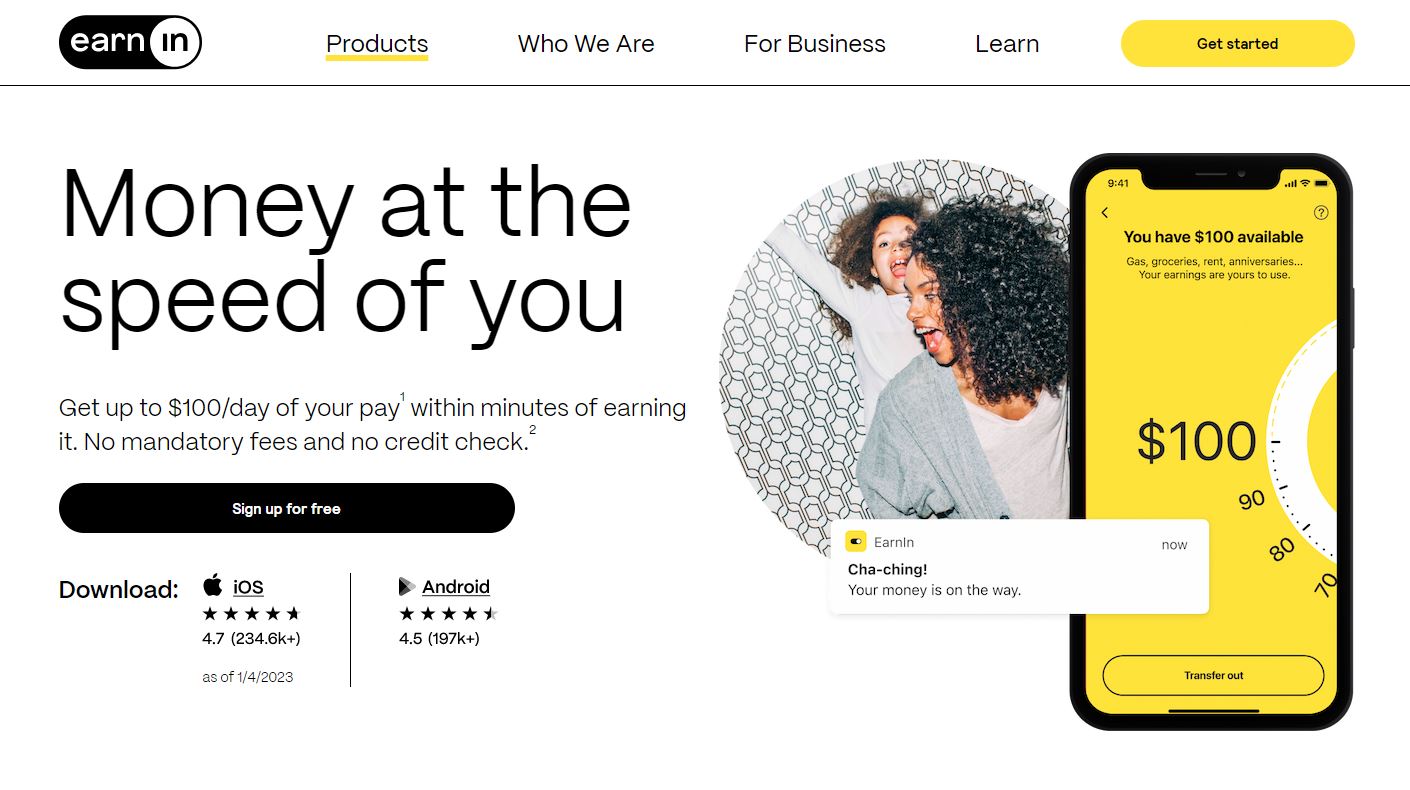

5. The newest mortgage bonuses

Once you re-finance, there is the possible opportunity to take advantage of brand new loan incentives, instance cashback also offers. Talking about more common whenever relocating to a different bank. However, on best dealings (and you can we will you thereupon!), you can also consult coordinating incentives out of your newest lender with a different financing equipment.

six. Debt consolidation

Your property loan could be probably one of the most cheaper loans which you yourself can previously availability. Due to this, you to definitely significant advantage out of refinancing is having the opportunity to consolidate your own more costly funds towards one to less expensive loan. This may become vehicles financing, signature loans otherwise handmade cards.

Without a doubt, it’s important to be mindful of aligning the loan title so you’re able to the life of your asset regarding whether or not to combine your financial situation. Including, if you combine an auto loan to possess a phrase regarding 29 decades, however simply support the vehicles to possess ten years, you will end up investing in a secured item you no longer enjoys.

At the same time, the amount of desire you will pay more than one to 30 year identity was significantly over you would spend or even. So it’s important to consider whether the complete focus you’ll shell out may negate the worth of your integration means.

In some instances, yet not, consolidating your debt causes it to be economical full. And it may and allows you to build that in balance monthly payment, as opposed to being required to juggle of numerous faster of them.

With respect to benefits, refinancing is difficult to beat. But one added bonus benefit of refinancing has a good people away from mortgage brokers trying to pick you the best service for your role.

There is certainly more often than not money as protected on your own mortgage. Link and you will to each other we could explore the choices and you will find the best contract on the market.