Most of the financial companies, as well as banking companies and you can borrowing unions, utilize the exact same financial qualifications to decide whom qualifies for mortgage loans (NBFCs). Yet not, even more standards is generally based on good lender’s specific recommendations. Just after familiar with the needs for getting home financing, the applying procedure have a tendency to flow more quickly and easily.

Age Limit

Whenever determining whether or not to offer home financing, a loan provider will at applicant’s many years among one circumstances. Banking institutions often you will need to cap the mortgage title during the borrower’s requested retirement age whenever approving home financing. This is why members of its twenties and you will thirties with established themselves expertly could possibly get qualify for that loan with an expression as much as twenty five years. Individuals above 40 could find it more difficult getting sensed to have a lengthier label, even if. Mortgage brokers to own single applicants aged 50 and over have traditionally become refused thus.

Income

Let us falter financial increases to the three organizations: salaried, elite, and you can mind-employed. Despite home loan qualifications , candidates must provide proof steady earnings. In the event that a borrower features regular employment, the lending company has less standard chance.

- Salaried: Somebody finding an everyday paycheck, if or not regarding bodies or a legitimate commercial providers, qualifies as the a beneficial salaried personal. Really financial institutions require people to have become within its boss getting per year before applying. Paycheck stubs, a completed Mode 16, financial comments, and you will a characteristics source out-of a current or prior boss are simple criteria out of pretty much every loan company. Co-applicant and you will guarantor documents is additionally called for (when the appropriate).

- Independent Positives: Physicians, dental practitioners, architects, engineers, government specialists, chartered accountants, and many more are some examples of mind-working positives. Bank statements and you may tax returns have to be given.

- Self-employed: Are you presently the head honcho in your providers or class? Do you have people offers out-of stock otherwise have any local rental features you to entice currency? Therefore, youre included in this group. When you yourself have lender suggestions and taxation documents to back up your home application for the loan, you’ll be able to do so instead of hesitation.

Interest rate

The newest Financeability away from a house financing was inversely proportional on the interest. A lot fewer individuals will meet the requirements in the event the rates try high, and you may vice versa.

Term of Financing

Choosing a lengthier title to suit your mortgage can boost the probability regarding approval. Lower and down EMIs is actually a different sort of work with. There clearly was a catch, regardless of if, because you pays additional attention.

Total Number of A fantastic Fund

Institutions delivering financial attributes inside India have a tendency to recommend a 50-60% EMI to earnings ratio. This can clear just how for your possible coming funds or obligations payment if any. One cbre loan services Crisman CO a fantastic bills can get really impact the power to engage.

CIBIL Rating

The credit Advice Bureau Asia Minimal (CIBIL) was India’s number 1 credit reporting agencies, and finance companies there may check your payment background with them carefully. It remain intricate ideas of your credit history and you may negotiations which have loan providers. If you have a bad admission, it might substantially fade your odds of being acknowledged.

Mortgage Qualifications Data

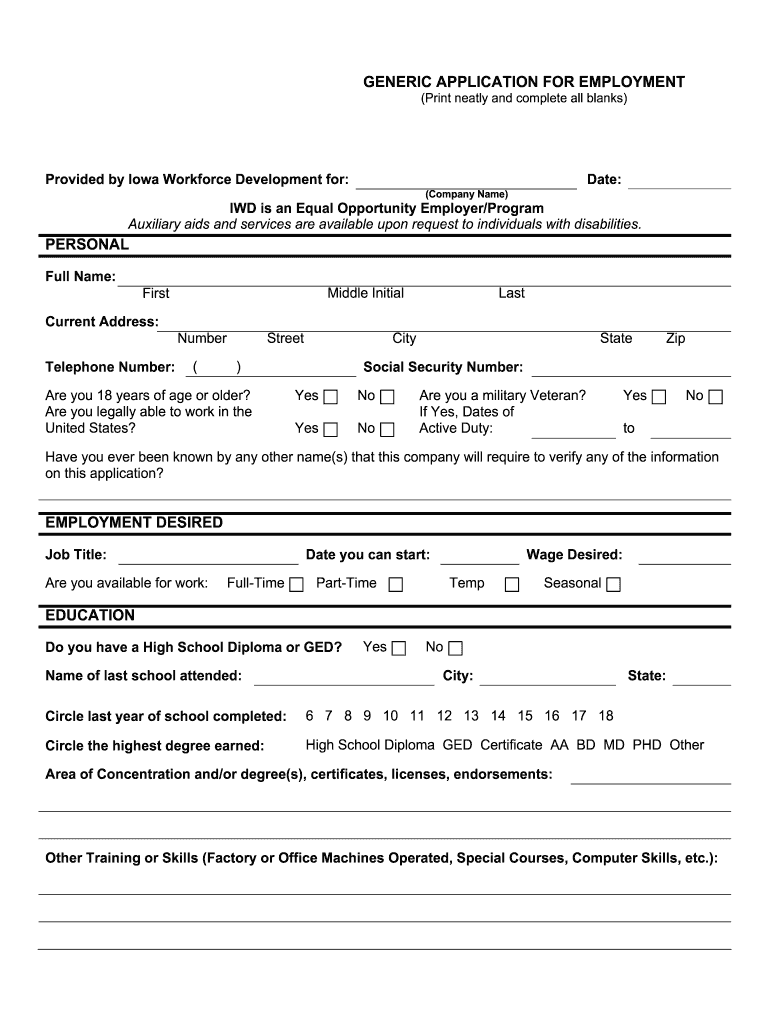

When trying to get a home loan, the fresh new detail by detail paperwork expected you’ll include that standard bank in order to another. It is customary getting an applicant in order to outline next:

- Evidence of quarters

- Proof of identity and current passport-measurements of images

- Financial records and you will comments

- Financial aid software, mortgage requests, an such like.

Ideas to Increase Mortgage Qualification

- Along with a premier-generating cousin while the good cosigner to the application.

- Accessibility a good lined up percentage plan.

Financial Qualification Calculator

The purchase out-of an initial residence is usually a life threatening milestone about lifestyle away from millennials as they change within their spots since the brains of their households. Although not, regardless of the potential great things about a residential property while the a financial investment, to find possessions might possibly be out of reach for many individuals, especially in more expensive nations. You can buy a home that you can telephone call your towards assistance of home financing.

Choosing pre-recognition getting a home loan is the first step in getting one. The degree of the month-to-month earnings, the degree of loans you already have, your age, additionally the lifetime one which just retire are typical facts one see whether you are acknowledged to possess a mortgage loan. It ount you be eligible for in a few activities.

Use your house Financing Qualification Calculator to select the maximum count away from a mortgage where you may be eligible. The genuine convenience of a person’s own house allows figuring house-financing estimates. To utilize the home loan qualification calculator considering, you really need to type in your month-to-month gross income, the mortgage title, and you will people current EMIs. It does show the most loan amount you are entitled to locate and EMI you to definitely goes with-it.

Conclusion

Potential individuals is to satisfy all financial qualifications criteria before applying for an interest rate. Numerous parameters are to thought, including age, earnings, employment standing, agency get, and you will worth of. Self-employed anyone and you can salary earners possess individuals conditions to be eligible for a home loan. So you can qualify for a mortgage loan, all you need to do is fulfill certain basic conditions. To learn more, consult with a professional during the Piramal Capital Home. You are going to have the advice.