My personal FICO get is actually 630. I’ve personal credit card debt off 70K. Exploit was previously 690 few weeks back(50k financial obligation).

I thought of purchasing a keen house(340k). What would all of you highly recommend? Will i get a home loan with this particular get?

Could it be a primary significance of one pick a home now? If not require it quickly, i then should suggest you to definitely choose for home financing immediately after there was specific change in your score.

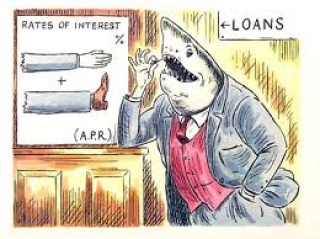

Which have a get out of 630 you will be eligible for a beneficial home loan nevertheless rates are not only you will love.

At least you could potentially contemplate opting for the home financing up coming. About mean time their rating tend to raise as you make the new costs.

It hinges on their needs. When the household criteria is not an urgent situation then it’s better to hold off as well as have less rate.

You won’t have the ability to be eligible for a knowledgeable costs which have a score of 630 you could score standardized speed otherwise a primary speed.

You can check with various loan providers the pace and program that you could meet the requirements and determine if you possibly could afford which have your revenue and you will coupons. The brand new standard off credit history is different with various loan providers and you may utilizes the amount of chance that they’re willing to take on.

In case your fee count isnt appealing to you, then you definitely would be to wait for sometime and try to replace your get to locate a lesser rate.

680 will be a score to get the most competitive rates although there are a Candlewood Orchards CT loans couple of competitive home loan applications that enables your so you can be eligible for a home loan which have a rating 630.

It largely relies on the type of mortgage system you favor plus more things such as deposit you can afford, your earnings as well as your deals trend.

Very, depending upon your situation you have to just take a decision.:) Paying debts is always smart as a result it never ever will get an encumbrance.

You’ll be able to take a look at the provided page understand how far family it is possible to afford:

Don’t panic. The reason for this group is not to scare your but we strive right here to sort our very own issues because of the mutual dialogue and you can thus assist to simply take a suitable choice. 🙂

I got when planning on taking money private resource(95% regarding credit line utilized)

Paying costs over time is obviously a good and you will bring maximum priority to it. Other countries in the conditions often automatically like your following.

There are lots of misunderstandings here. With the a compliant loan that have score more than 620 and even under 620 a brokerage financial would you a conforming acceptance. DU (desktop computer underwriter) assesses exposure although your overall credit score do come in gamble, youre expected to rating a higher level due to financial obligation ratio and even deficiencies in supplies together with the ltv. That said it truly does not hurt to sit down with a lender/representative and you will remark the choices. Your debt must be something given that min. payment has grown so much to your alterations in this new financial laws the initial of the season. And so the genuine matter you must ponder is actually: Perform I want to take on so much more debt we.elizabeth a home loan when the credit card debt is really so higher. When you are paying ninety% might possibly be great so long your proportion it is possible to fool around with a number of that cash when it comes to a down percentage. simply my $.02